What is Tax Planning, Anyhow?

Like it or not, we’re smack in the middle of tax season. I often tell the families we serve that one of the areas we provide the most value to their financial wellbeing is through tax planning. Not only are taxes complex and confusing, but tax laws are constantly changing. It’s not surprising that people (and even some financial advisors 😬) don’t give this important topic the diligence it deserves. But a good tax plan can often result in thousands (millions?!?) of dollars in tax savings throughout your lifetime. This gets truer the more money you make or the more complicated your tax profile.

Many think that tax planning means we help clients prepare their tax returns. Nope. No need to plan for things that are too late to do anything about. And tax advice usually deals with one very specific scenario and stops there. Tax planning, on the other hand, is very much a forward-looking and holistic process. Its goal is to look at your entire financial picture to minimize the amount of your tax liability not just this year, but throughout your entire lifetime.

Understandably this subject can get very confusing, so let’s use a fun example to make the point. Here are some assumptions for John and Jane Luvtax¹:

| John | Jane | |

|---|---|---|

| Age | 40 | 37 |

| Salary | $100,000 | $100,000 |

| 401K Contribution | 10% | 10% |

| Employer Match | 4% | 4% |

| Current 401K Balance | $130,000 | $110,000 |

| Retirement Age | 60 | 57 |

| Social Security Age | 65 | 62 |

| Llife Expectancy | 95 | 98 |

| Annual 401K Return | 8.6% | 8.6% |

| Annual Inflation | 2.5% | 2.5% |

As you can see, the Luvtax family are diligent savers doing everything that they’re supposed to. They’re told by their un-insightful financial adviser to just keep contributing pre-tax dollars to their 401k to reduce taxes each year. While it’s true that saving entirely in pretax accounts will reduce taxes this year, the adviser is not looking far enough ahead to understand the implications of this.

Now it’s 2043 and the Luvtax are ready to retire. They’ve accumulated an impressive $3 million in their 401k’s.

They’ll use this to fund their expenses until Social Security kicks in. Let’s assume they’ll need about $14,000 per month to cover their living expenses. To do that, they’ll withdraw about $200,000 per year from their 401ks, which results in a 6.6% withdrawal rate. When Social Security kicks in, they’ll only need to withdraw about $125,000 from their accounts, while their 401k balances are now $3.4 million combined for a 3.7% withdrawal rate. Since their accounts are generating more than what they’re withdrawing, the balances grow each year.

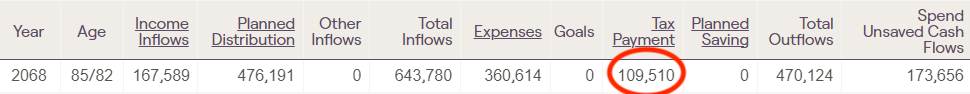

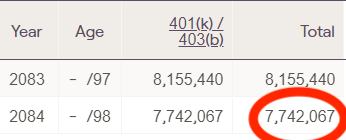

That’s good news, right? Well, it is … until their Required Minimum Distributions (RMDs) begin when they turn 75. You see, this money has never been taxed, and Uncle Sam wants to get its dirty paws on it. RMDs require you to take a certain amount from pretax accounts, even if you don’t need the money. What’s worse, the amount required to be withdrawn gets bigger each year. By the time John is 85, their combined RMD is $476,000 on top of their $167,000 in social security benefits. That leads to a massive $100,000 tax bill.

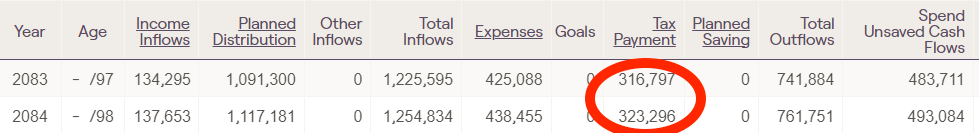

The problem escalates each year and gets really shitty when Jane is a widow and has to file “Single” on her tax returns with a lower standard deduction (by the way, this is called the “widow’s tax penalty”).

Can you imagine a tax payment of over $300,000 PER YEAR? Shame on their financial advisor.

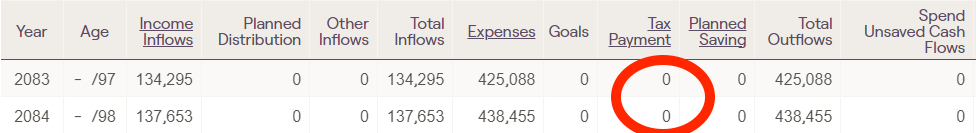

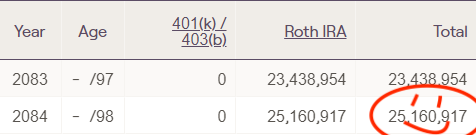

But with a little tax planning, it doesn’t have to get this fugly. Let’s say that a savvy financial life planner anticipated this problem and recommended they initiate Roth Conversions, especially in the years right after retirement when their income was low. Yes, this causes them to pay more in taxes now, but in the long run they’ll be in a much better position by paying lower tax rates on their distributions. In fact, by the time John is 70, all their pretax accounts are now tax-free so they don’t even have RMDs to take. Let’s compare the numbers when John is 85…

…and when Jane is a widow.

Their only taxable income are Social Security benefits that get favorable tax treatment. For the Luvtax family, this means millions of dollars that were saved from taxes. This is their accounts without tax planning…

…versus this with tax planning.

Obviously, this example is a bit simplistic, but I’ve seen problems like these way too many times to know that tax planning matters. And this is just Roth Conversions. Don’t get me started on stock options or deferred compensation.

So if you (or worse yet, your un-insightful financial advisor) are not doing a deep dive into your taxes, it’s time to wake up and smell the tax savings.

The following numbers and projections are calculated using our financial planning software using the assumptions above. This is meant to be an example only and the analysis and recommendations are not investment or tax advice.

Want to find how tax planning could save you thousands or more over your lifetime? Click below to schedule a free intro call today.